What are Some Key Components to Successful Budgeting

The budget. If you’ve been following me for any length of time, you’ve probably heard me emphasize the importance of a budget! There are so many feelings, ideas, and perspectives that come with budgeting, but here’s what we think about a budget at Core Life Habits.

No matter what income you make, EVERYONE should have a budget.

A budget isn’t a “I’m doing bad with money” tool. It’s a “I’m being intentional with my money” tool.

A budget is a PLAN that YOU make telling YOUR money where to go vs. wondering where it went (or knowing where it went and not being happy with it…)

A budget allows you to keep track of your income and expenses, variable spending, and helps you make sound decisions based on this tracking.

A budget helps keep you organized and stay on track with your plans and goals.

A budget helps you create a plan to achieve your financial goals! Saving Money, Debt Elimination, or long term financial goals like Investing, Real Estate Purchases, etc.

Budgeting can seem complicated at first. You are gathering ALL your information in one place. A list of your bills, when they’re due, how much is due, interest rates, your grocery bills, 401ks, all of it! It’s a lot. BUT having all of your information organized, in one place, and visible for you to check in on is one huge key to your financial freedom in the long run.

With anyone I’ve worked with, the number one tool that they share was a game changer for them was the budget. They have a completely new level of awareness of where they are at and where they’re going. The budget was their KEY to success in achieving their goals!

This post is dedicated to anyone who is just getting started with working on their financial life. The budget is THE place to be!

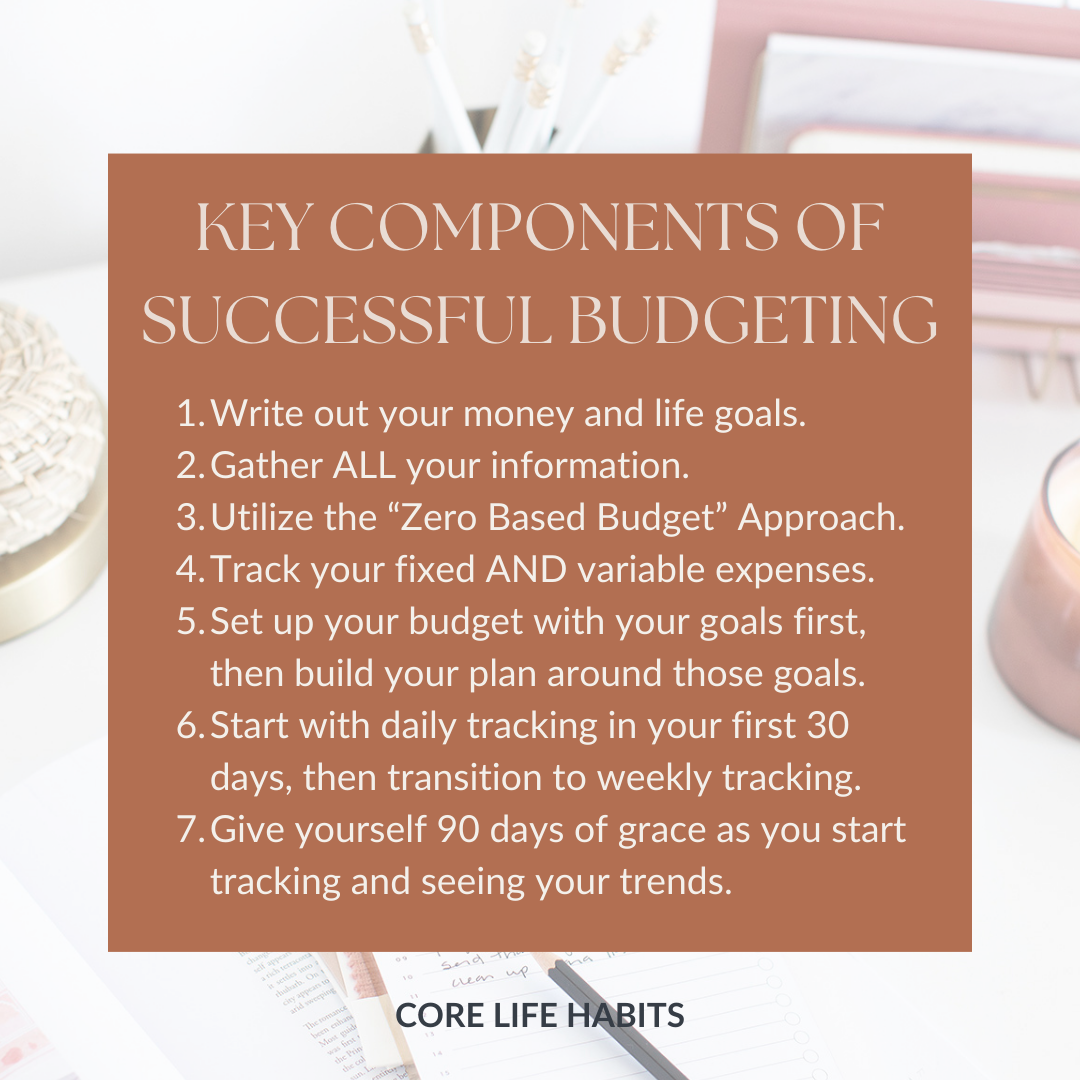

What Are Some Key Components Of Successful Budgeting

Here are some key elements of what makes up successful budgeting.

Have a written list of your money and life goals.

Gather ALL your information.

Utilize the “Zero Based Budget” Approach.

Track your fixed AND variable expenses.

Set up your budget with your goals first, then build everything around those goals.

Start with daily tracking in your first 30 days, then transition to weekly tracking.

Give yourself 90 days of grace as you start tracking and seeing your trends.

I’m telling you, if you follow these steps above, I have 100% confidence that you are on the right path to success with your financial future! Let’s break these down 🙂

Write out your money and life goals.

Your plan won’t make sense if you don’t have goals or a purpose behind it. Here are some questions or categories to consider when it comes to your money goals.

Why am I wanting to create a budget?

Am I wanting to save money? If so, how much, by when, and for what purpose?

Am I wanting to eliminate my debt? If so, how much and by when?

How much money would I be saving in minimum payments monthly if I got rid of my debt? What would I do when that money is freed up?

How about retirement investing?

What are my goals with real estate? Do I want to buy a home? Own a rental property? How much money will I need to save up for a down payment?

What are other goals I have in life? 9 times out of 10, they cost money. I.e. travel, start a business, etc.

If you feel lost just by going through these questions, set up some time on my calendar and I can help you navigate what direction to go based on what you’re goals are! :)

Gather ALL your information.

When I say ALL of your information, I mean ALL of it. Here’s a list to start working on.

All Bank Accounts

Account Type, Current Balance (even if you don’t use the account, or there is $1 in there, write it down!)

Checking Accounts, Savings Accounts, Money Markets, CD’s, etc.

All Fixed Household Expenses

Bill type, due date, amount due

Ex. Mortgage/Rent, Utilities, Internet, Phone, Home Security, Subscriptions, Memberships, etc.

PRO TIP: List these out in order of due date from 1st-31st of the month

All Debt Details

Debt Name, Interest Rate, Due date, Minimum Payment

PRO TIP: List these out in order of smallest to largest balance NOT your high interest debt first. Check out the blog post on 5 Personal Finance Rules to Live By to learn why.

All Insurance Policies

Policy Type, Due Date, Amount Due

Home/Rental, Auto Insurance, Life Insurance, Health Insurance, etc. If the policy is through your work, still write it down but don’t include it in your budget that you are tracking with your take home pay since they take this out before they send you your check.

Real Estate Details

Mortgage Type (i.e. 15 year, 30 year), Interest Rate, Due Date, Amount Due

Investment Accounts

Account Type, Account Balance, Contribution Amount

Think 401k, IRAs, Brokerage Accounts

List of Assets

Asset Type, Estimated Value

Ex. Cars, Jewelry Collection, Real Estate, etc.

Utilize the “Zero Based Budget” Approach.

Creating a Budget that has the “Zero Based Budget” approach is simple and so effective! Here’s the equation.

Income - Expenses = 0

This does NOT mean 0 dollars in your bank account. You’ll likely have cash sitting in your checking at the start of each month. What this means is that each dollar of income coming in during the upcoming month is accounted for SOMEWHERE. Whether it’s being saved, given away, or spent on a bill or expense. You are giving every dollar a name and place to go. There is no leftover money here!

Track your fixed AND variable expenses.

Most people I meet with do have some framework about knowing most of their fixed expenses/bills and make sure those are all paid. BUT are you tracking all your spending outside of your bills? This is where the real revealing part comes! Here are some categories to look and see if you’re allocating funds to.

GIVING

Birthday Parties, Showers, Donations, Tithes, etc.

FOOD

Groceries and Restaurants/Drive Thru

SAVING

Emergency Fund, Kids College, Taxes, etc.

CLOTHING

For you, or the kids, or dry cleaning services

HOME

Mortgage, Lawn Care, Home Cleaning Services, HOA, Repairs/Maintenance

TRANSPORTATION

Gas, Repairs/Maintenance, Car Washes, Tags/Registration/Inspection, Uber/Lyft, Train Tickets, Parking, etc.

UTILITIES

Electricity, Water, Gas/Trash, Phone, Internet, Home Security System

MEDICAL/HEALTH

Doctor Visits, Vet Expenses, Therapy Appointments, Prescriptions, Supplements, etc.

INSURANCE

Home/Renters, Auto, Health, ID Theft, Life Insurance, etc.

RECREATION

Entertainment/Fun Spending

Vacations/Travel

DEBT

Auto Loans, Student Loans, Credit Cards, Store Cards, Tax Debt, Collections, Personal Loans, Medical, After pay, Other Payment Plans, etc.

OTHER PERSONAL SPENDING

Hair Cuts, Dog Grooming, Gym Memberships, Hair/Nail/Spa Services, TV/Music Subscriptions, Coaching Services, etc.!

PRO TIP: Be sure to leave a Miscellaneous bucket for any unexpected expenses that may come your way. This again is hard to predict how much in the beginning, so be generous at first and then you can narrow it down as you track along the way.

Set up your budget with your goals first, then build your plan around those goals.

This is my FAVORITE tip! What I often see as the problem is just a lack of prioritizing. If you created your plan around your goal first, it gives you a guideline on how much you can spend everywhere else. This is one of the many reasons Why it's difficult to Save Money.

Example. If your goal is to save $300 a month to save up your emergency fund, put that on the budget FIRST and build your spending around this. That will show you if you really have money to go buy those cute clothes, or how much to spend when eating out.

Not only should you write it on the plan first, but you should also do this as early as possible in the month, or right when you get your paycheck. Don’t let there be an opportunity where money is spent that you didn’t plan on! Doing this tip alone can help you stay on track in achieving financial goals you’ve been waiting on for a while!

Start with daily tracking in your first 30 days, then transition to weekly tracking.

Now that you’ve got your plan written out and your goals in line, it’s time to TRACK! There is a difference between what we plan and what ends up actually happening.

Download your bank app on your phone, login and select the account where most of your spending comes from, and track EVERY transaction. Yes, every one. Even if it was that $.99 apple storage. Everything adds up!

Doing this daily helps from the piling up of transactions, forcing you to sit down for a long period of time. With busy lifestyles, we have moments here and there but a lot of time carving out an hour or two to do this is unrealistic, especially as you’re getting in the habit. Set an alarm and a timer for 5 min. to log in, track the few transactions, and be done! That way you can see what’s happening and how you’re pacing as the month goes, vs. not being able to do anything about it once the month is over.

Once you’ve established a strong habit of tracking, you can transition to doing this weekly as your speed picks up!

Give yourself 90 days of grace as you start tracking and seeing your trends.

As with any new habit or adventure, give yourself grace and time. Don’t expect perfection (really ever), but allow yourself the time to really see the trends of where your spending is at, and adjust your lifestyle to see the changes you want to see!

Change takes time, but it’s not impossible if you plan, track, and commit!

I can’t wait to see you get started in building your first budget and seeing how it transforms your life and perspective with money!

If you feel like you need some guidance or support as you get started in setting up a realistic budget that’s also aligned with your goals, don’t hesitate to reach out for Financial Coaching. We are here to help you set up your financial plans that make sense for you and your family! Whether it be a goal to just become more aware of your spending, eliminate debt, or get plans in place for your savings and investments, we are here for you!